Home prices across the U.S. have been on a mostly upward trajectory since the bottom of the recession. The conventional wisdom is that a recovered, growing economy and a dearth of housing stock (and construction) is causing prices to rise.

But another factor may be playing a big role: increasing demand and high-risk home purchase lending. These two forces are stimulating rapid home price growth, according to a recent briefing from the American Enterprise Institute’s (AEI) Center on Housing Markets and Finance (AEI is a well-regarded non-profit conservative think tank).

In Q2 2018, AEI’s home price index, which covers the nation’s 73 largest core-based statistical areas (CBSAs), increased 7.0 percent quarter-over-quarter with the highest hikes being at the lowest price tier (+8.2%).

Despite these home price hikes, new and existing home sales rose 0.2 percent quarter-over-quarter to 6.37 million, something AEI says is the result of relaxed lending standards that have allowed a surge of credit-challenged buyers to enter the market.

AEI Senior Research Analyst Tobias Peter explained that in a competition for first-time buyers, FHA and Fannie Mae have been providing loans to buyers with debt-to-income (DTI) ratios of greater than 43 percent (the current DTI maximum set by the Consumer Financial Protection Bureau) as a way to compensate for the gap between home price and income growth.

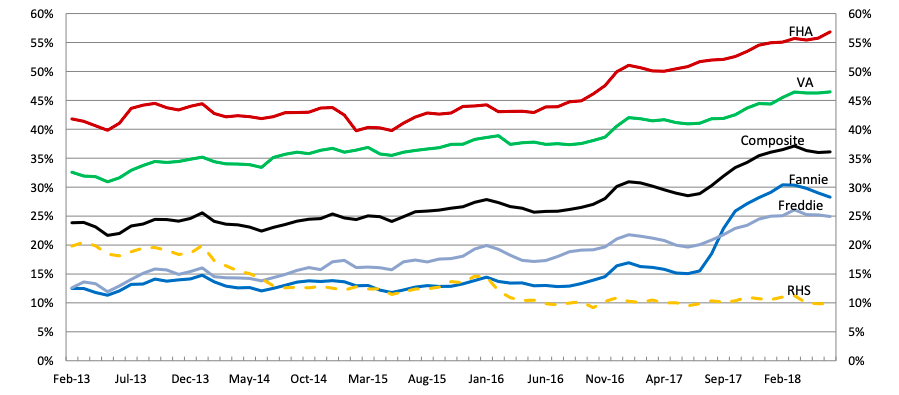

Purchase loans with a debt-to-income ratio of greater than 43%

As of February 2018, a little more than 55 percent of FHA loans have gone to borrowers with a DTI ratio of greater than 43 percent, a 6 percentage point increase from February 2017. During the same time period, Fannie Mae increased the number of loans it provided to borrowers with a DTI ratio of greater than 43 percent by 13 percentage points to 28 percent.

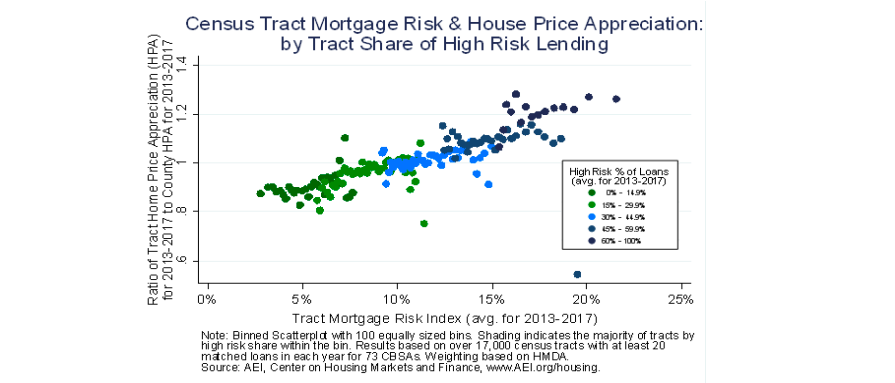

Now that these buyers have relatively easy access to credit (albeit high-risk) they’re snapping up homes at the lowest price tier and driving up home prices, as evidenced by a correlation between higher mortgage risk indexes (a measurement of default risk) and higher home price appreciation.

The higher the risk, the higher the appreciation.

The report showed that in census tracts with an MRI of less than 15 percent, the ratio of tract to county house appreciation is 0.86 percent. Meanwhile, in census tracts with an MRI of 60 percent or greater, the ratio is 1.19 — a 38 percent increase from tracts with an MRI of less than 15 percent.

This trend held true in 68 of the 73 core-based statistical areas included in the analysis, except for San Jose, Seattle, and New Orleans. In San Jose and Seattle, Peter noted, below average days on market and strong sales at the highest price tiers (+30 percent since 2013) counterbalanced the mortgage risk effect from the lower tier. New Orleans, he said, was merely an outlier.

AEI Codirector Edward J. Pinto noted that FHA, Freddie Mac, and Fannie Mae’s high-risk lending practices will continue to the detriment of first-time homebuyers, and he paid special attention to Fannie Mae, which has doubled the number of high-risk loans its issued over the past two years.

“Freddie seems to have been choosing its battles in terms of risk management whereas Fannie has been increasing its risk appetite,” Pinto said. “Fannie, [mortgage risk index] overall went up from 5 to 7.5 in five years so it’s gone up roughly 50 percent. For first-time buyers, it’s gone from 6 percent to 10 percent. With first-time buyers, that’s where the rubber meets the road.”

“When that percentage in these entry-level markets, the low and the low-medium, gets above 30 percent high risk, that’s when the price pressures really take off upward in terms of price appreciation,” he added.

Pinto says an overhaul in the U.S. housing policy that reduces the reliance on high-risk lending is needed to better serve buyers.

“The U.S. housing policy for decades and decades has relied on foreclosure prone, high-risk lending to first-time buyers through poorly targeted and opaque subsidies,” said Pinto. “That’s exactly how FHA operates and that’s exactly how Fannie and Freddie operate.”

“That is the problem. We need to change that approach,” he added. “It does not serve first-time buyers well, it does not serve taxpayers well. It does not serve the American people well.”

This article was pulled directly from Inman News with no curation or modification by Affinity Hills Realty. The views and opinions of authors expressed in this publication do not necessarily state or reflect those of Affinity Hills Realty, its affiliated companies, or their respective management or personnel.